Tax preparation services support from Protection Plus. If you receive a notice, inquiry, or audit, Protection Plus will provide up to $1,000,000 worth of services to find a resolution. Our audit defense team is composed of highly skilled and qualified tax resolution experts who will work diligently on your behalf. Additionally, our Privacy Advocates are available to provide support and assistance in the event of an identity theft incident, whether related to taxes or not.

Copy Content

Tax preparation services support from Protection Plus. If you receive a notice, inquiry, or audit, Protection Plus will provide up to $1,000,000 worth of services to find a resolution. Our audit defense team is composed of highly skilled and qualified tax resolution experts who will work diligently on your behalf. Additionally, our Privacy Advocates are available to provide support and assistance in the event of an identity theft incident, whether related to taxes or not.

Ready-To-Post Social Media Content

Below you‘ll find ready-to-post content and captions to use on your social media platforms. Simply download the content images, copy/paste the caption and post on the social media platform of your choice! You are welcome to cobrand the content images with your logo. Need advice on how to add your logo? Read about how to do this on an easy to use, free platform here.

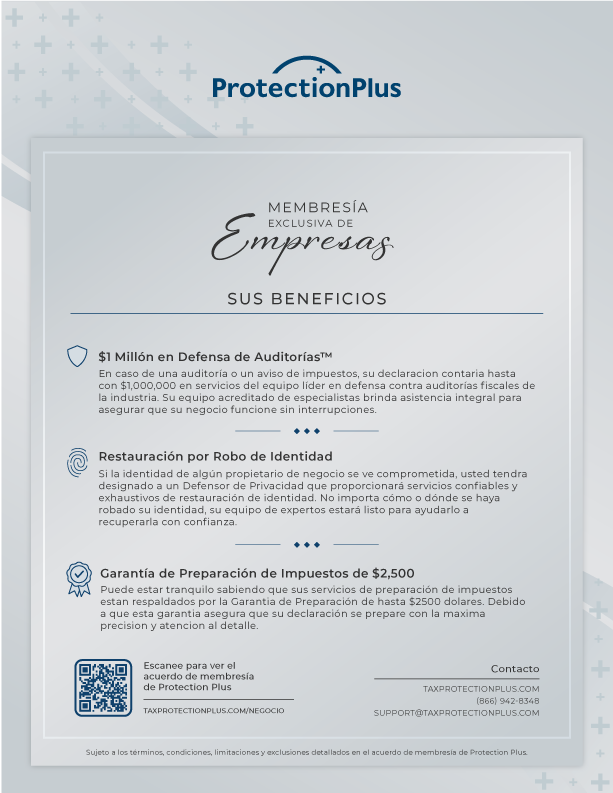

IRS Letter

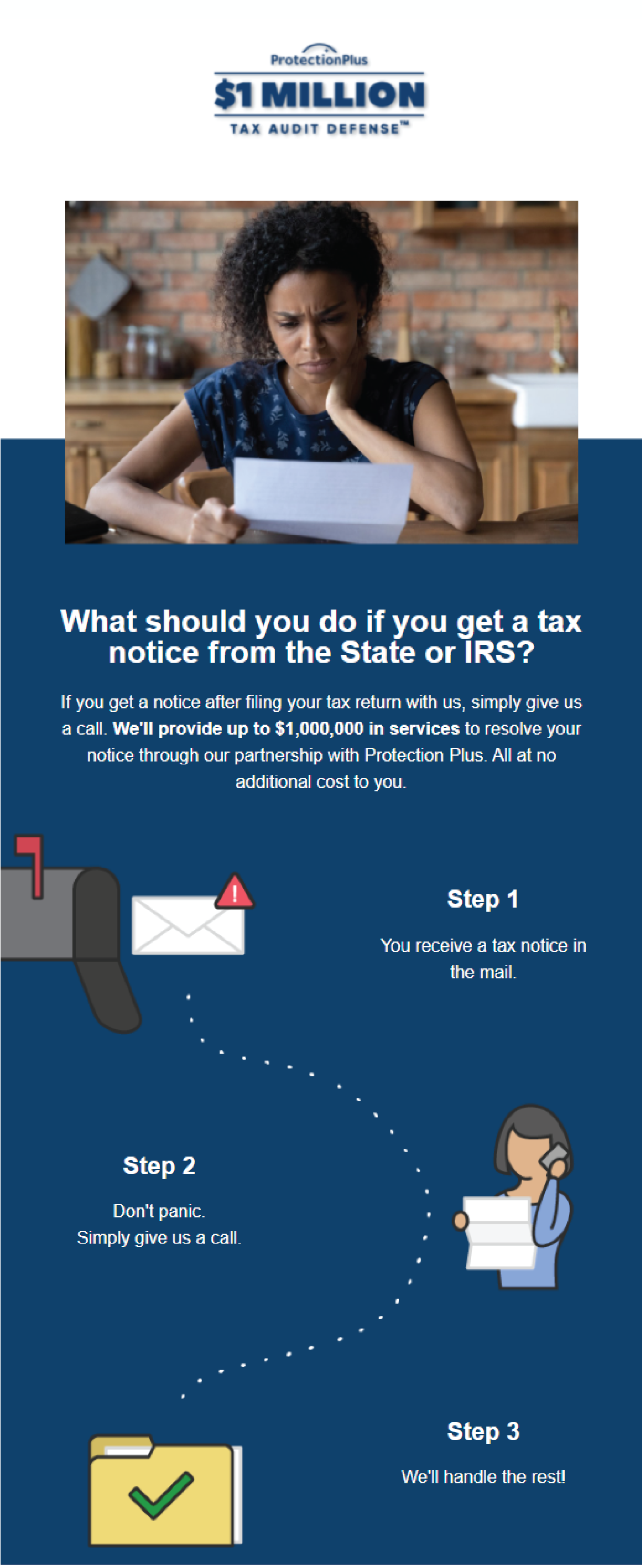

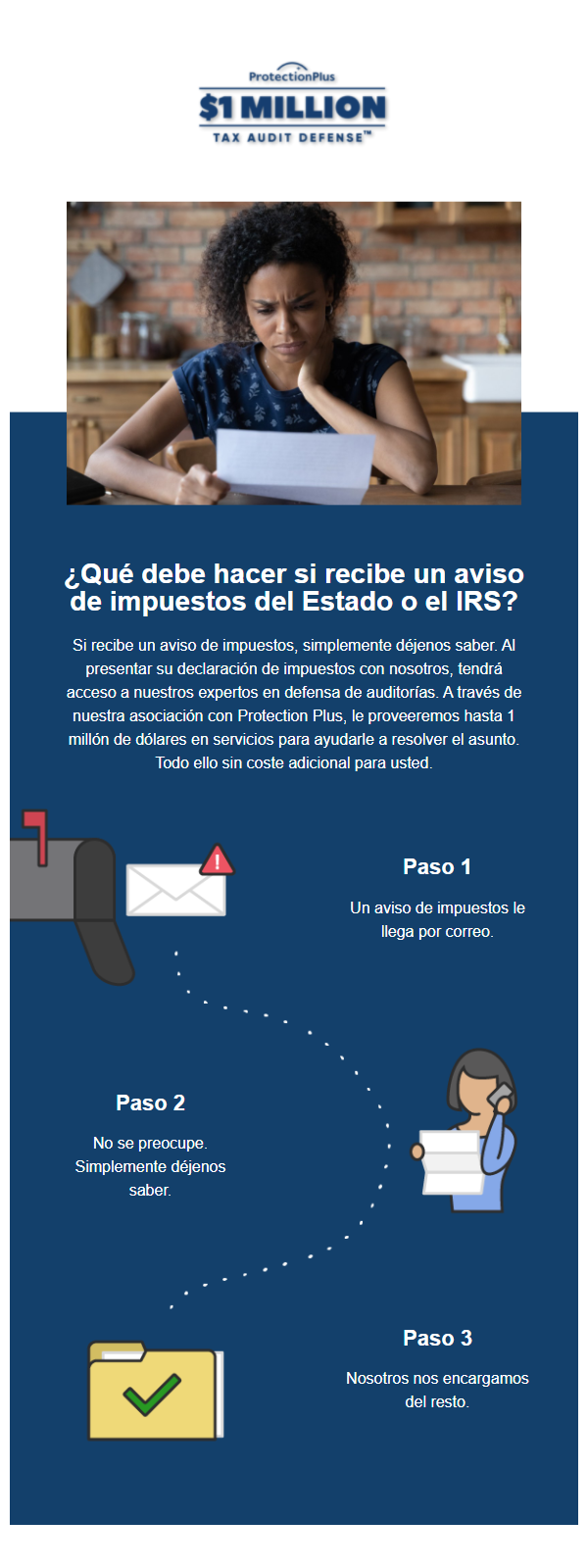

Received a letter from the IRS or state about your tax return? Don't worry, send it our way! Through our partnership with Protection Plus, we have an entire department that specializes in resolving tax notices. We'll ensure that any notice you receive is resolved in an effective and efficient manner. File with confidence!

Experience a Difference

When you file with us, you're not just getting expert tax filing - you're gaining Protection Plus $1 Million Tax Audit Defense™. If you receive a tax notice, simply notify us, and we'll provide up to $1,000,000 in services to reach a resolution.

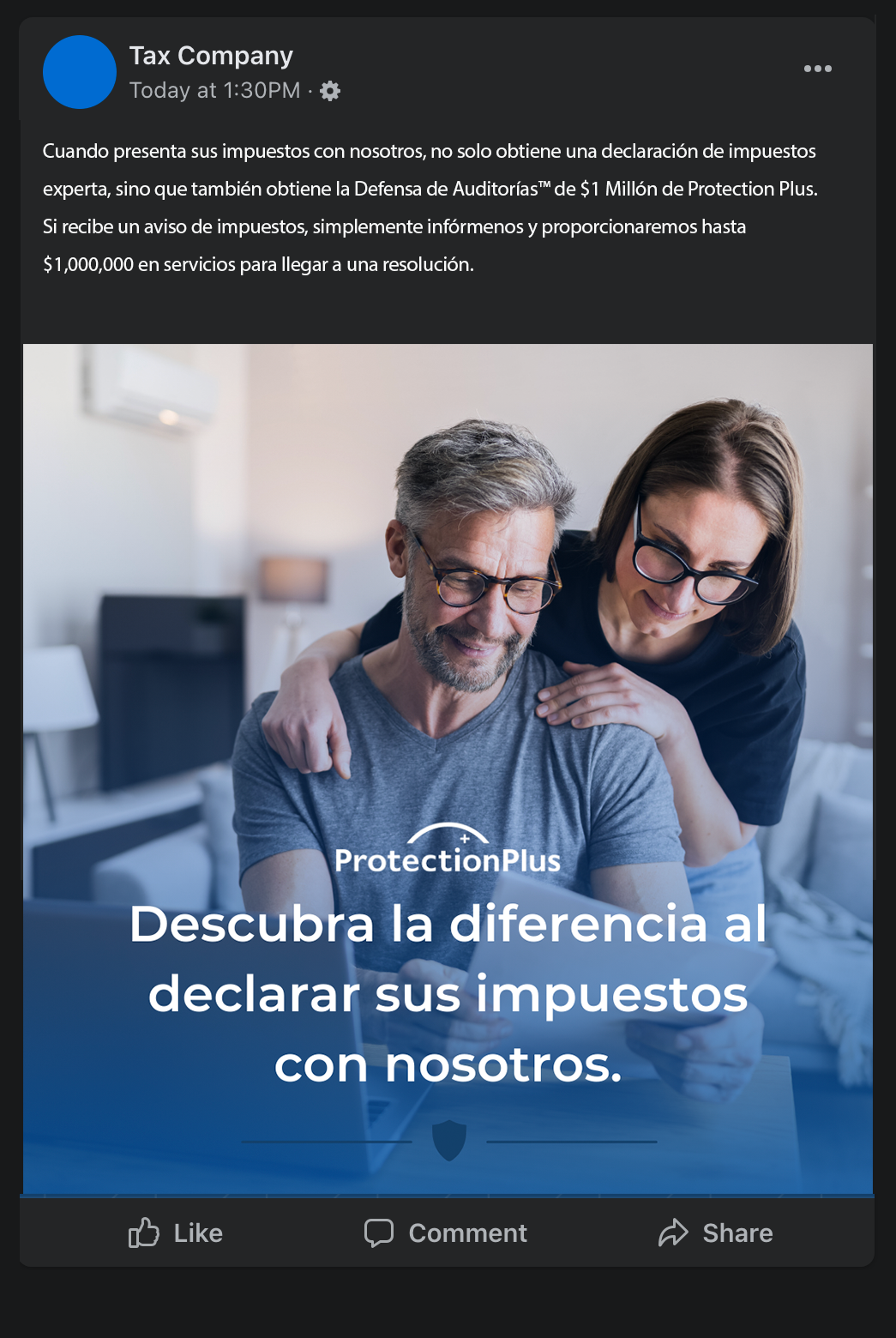

Identity Theft Restoration Services List Version 1

If you suspect that your identity has been stolen, don't worry! Our tax return filing service includes comprehensive Identity Theft Restoration services through our partnership with Protection Plus. Benefit from: Fraud alerts, notify the right banks or agencies, alerting the local authorities, assistance with interpreting credit reports, credit monitoring for 6 months after an incident, and more!

Identity Theft Restoration Services List Version 2

Through our exclusive partnership with Protection Plus, we're proud to offer thorough identity theft restoration services to help you recover your identity, no matter how it was compromised. (Even if it's not related to your tax return!) Our team of experts is dedicated to working with you to restore your identity and protect you from future threats.

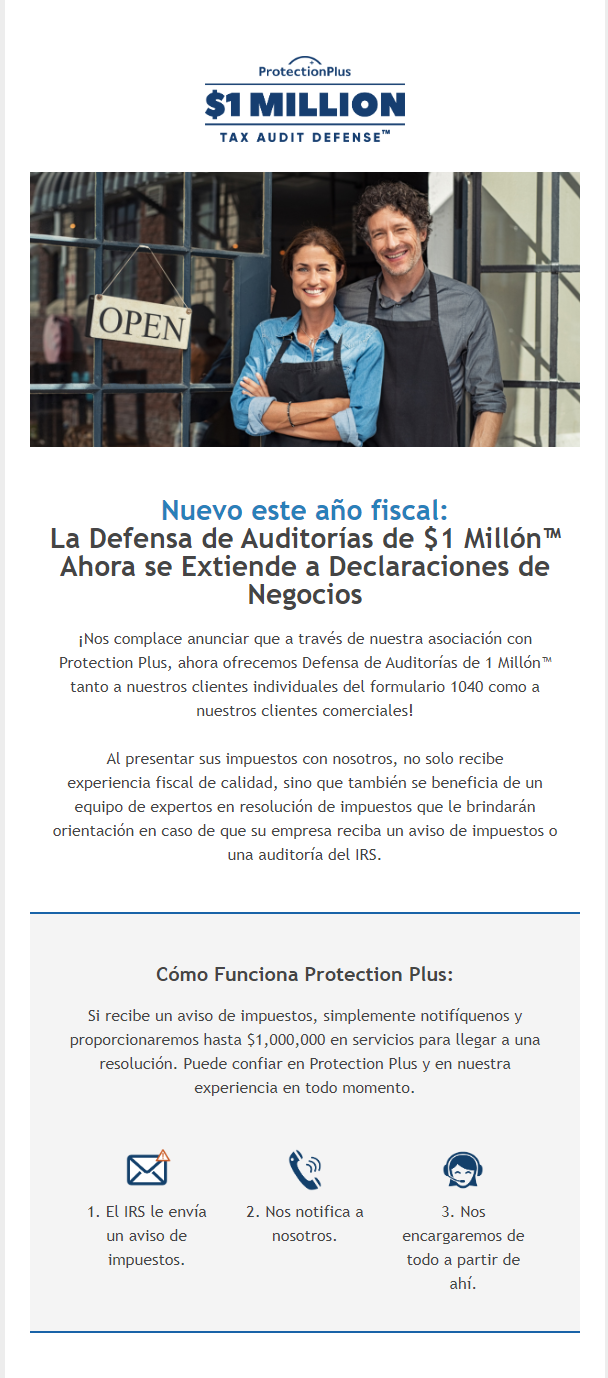

Business Support Version 1

Exciting news! This tax year, we're proud to extend tax audit defense support to our business return clients through our partnership with Protection Plus. If you receive a tax notice regarding your business return, notify us, and we'll promptly assist in resolving the issue. You can count on us!

Business Support Version 2

We understand that taxes can be stressful, especially when you're a business owner. That's why we're thrilled to announce that we've partnered with Protection Plus to provide you with extra support this tax year. This means that if you receive a tax notice related to your business return, we've got your back! Our team is dedicated to making your life easier, and we're here for you every step of the way. So, sit back, relax, and let us take care of it for you!

Breathe Easy Version 1

Did you know audit defense is included when you file your return with us? We want you to have peace of mind even after successfully filing your return. So, if you receive a notice from the IRS, don't worry! We've got it covered.

Peace of Mind Version 2

If you receive an audit notice, letter, or inquiry after filing your tax return, there is no need to worry. Through our partnership with Protection Plus, we have an entire audit defense department at your service.

Phone Notification

Receiving a tax notice from the IRS is never a welcome occurrence. Fortunately, we partner with Protection Plus, the industry-leading tax audit defense service. If you receive a tax audit, letter, or notice, you’ll be backed by their $1,000,000 Tax Audit Defense ™ program.

Worry-free Beach Dog

The IRS sends out over 200 million notices every year. Through our partnership with Protection Plus, you will have the peace of mind that comes with our $1 Million Tax Audit Defense ™ program. If you receive a notice, our team at Protection Plus will spend up to $1,000,000 of services to find a resolution.

Peace of Mind Version 1

Protection Plus is our premier partner for tax audit defense and identity theft restoration. If you receive a tax notice from the state or IRS, you can rest assured that you'll have an experienced team on your side.

File With Confidence

We make dealing with a tax notice easy and stress-free. If you receive a notice, we have an entire team ready to assist. This is just one of the many benefits of working with us to file your tax return.

Breathe Easy Version 2

When you file with us, you have access to Identity Theft Restoration services provided by Protection Plus. In the event of an identity theft issue, they offer resources to aid in the restoration of your identity.

$1 Million Tax Audit Defense™

Do you know how to respond to a tax notice from the IRS? Luckily, you don’t have to be an expert in audit defense. If you file your tax return with us, we’ll spend up to $1,000,000 in services to find a resolution through our partnership with Protection Plus.

Preparer Guarantee Version 1

Through our partnership with Protection Plus, we guarantee our work for $2,500. If we make a mistake in the preparation of your 1040 tax return, we will reimburse you up to $2,500 for additional fees, penalties, and interest. Subject to terms and conditions

Preparer Guarantee Version 2

We’re confident in our work and we have a guarantee to back it up. If we make a mistake in preparing your 1040 return, we’ll reimburse you up to $2,500 for additional fees, penalties, and interest through our partnership with Protection Plus. Subject to terms and conditions.